Junior explorer Okapi Resources (ASX:OKR) has acquired multiple large-scale kaolin halloysite and mineral sands projects in Western Australia and South Australia under a binding Heads of Agreement with Bulk Mineral Holdings. Kaolin halloysite is essential for High Purity Alumina (HPA) production – a key ingredient in semiconductor wafers, lithium-ion batteries and LED lighting.

The acquisition provides Okapi with the Holly Kaolin Project in Western Australia and the White Knight Kaolin-Halloysite Project in South Australia – a combined land package of around 2,127km². The Holly Kaolin Project includes two granted exploration licences while the White Knight Project comprises four exploration license applications.

Recent site visits at the Holly Kaolin Project confirmed widespread outcropping kaolin mineralisation with historical drill results from a large-scale drilling program in 1995 including high brightness kaolin intercepts of greater than 85 percent. Based on historical drilling data, the average depth to the top of the mineralisation appears to be approximately 5m. Previous drilling in 1996 identified a 11-metre thickness of white clay.

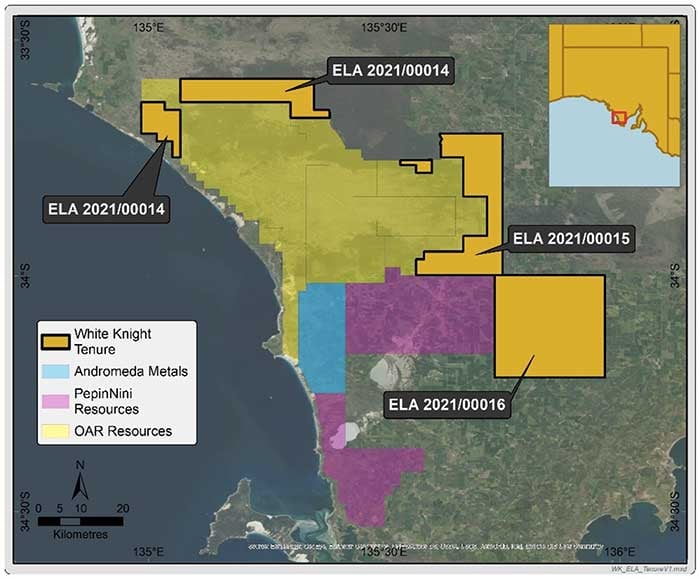

Meanwhile, the 1,943 km2 White Knight Kaolin-Halloysite Project is prospective for heavy mineral sands and kaolin halloysite. The tenement borders Andromeda Metals’ (ASX: ADN) Camel Lake Project, where halloysite makes up between 9-72% of the clay sediment. The halloysite at Andromeda’s Camel Lake is high grade and Okapi said it will focus on whether the kaolin halloysite mineralisation extends from the Camel Lake project area north into the White Knight tenement when the tenement is granted.

Under the agreement, Okapi will issue 7.1 million fully paid ordinary shares in the company to the vendors of Bulk Mineral Holdings at an issue price of $0.21 per share, amounting to a consideration of $1,491,000. Okapi will issue the shares under two stages –4.6 million shares will be issued in stage 1 and the remaining 2.5 million shares will be subject to the successful grant of the four White Knight exploration licenses.

Subject to completion of Stage 1, a joint venture between Okapi, the vendors and the relevant subsidiaries will be established in relation to the Holly Kaolin Project. Subject to completion of Stage 2, a joint venture will be established between Okapi, the vendors and subsidiaries in relation to the White Knight Kaolin-Halloysite Project. The vendors will incorporate a new entity, Newco, for participation in the JV for exploration of the Projects. Okapi will hold 80% in the JVs and 20% will be held by Newco. The Newco interest will be free carried until a decision to mine the Projects, at which point an 80:20 mining joint venture would be established. Okapi would continue as the Manager of the JV and the parties to contribute to the JV according to their respective shares.

Commenting on the acquisition, Okapi Executive Director David Nour said, “The Board of Okapi is excited to embark on this exciting new chapter for the Company. This acquisition puts Okapi in a highly prospective ground in the heart of major known kaolin halloysite deposits neighbouring the likes of Andromeda Metals. Additionally, historical drill results show the potential of the Holly Kaolin Project in which we will commence exploration work immediately to confirm the quality of the project.”

“With the fast-moving technological advances in kaolin halloysite, potential application extends beyond traditional uses to now include batteries and super capacitors, hydrogen storage and construction. We are also excited about Okapi’s upcoming drilling campaign at our Enmore Gold Project where we aim to drill an initial 8-12 holes to confirm further gold mineralisation.”

To fund acquisition costs and exploration on both projects, Okapi raised $700,000 before costs via a share Placement to eligible sophisticated and professional investors. Under the Placement, Okapi will issue 3,333,334 new shares at an issue price of $0.21 per new share with one free attaching Listed Option for every new share subscribed. The Listed Options have an exercise price of $0.30 each and expire on 31 March 2023.

Okapi also announced several Board changes, including the resignations of Directors Andrew Shearer and Rhoderick Grivas with immediate effect due to potential conflict of interests. Non-Executive Director Raymond (Jinyu) Liu also resigned to allow for the transition to a new Board and management.

Non-Executive Director David Nour and Company Secretary Leonard Math have both been appointed as an Executive Directors while Non-Executive Director Peretz Schapiro will take on the role as Interim Chairman. Okapi said it will commence searching for a technical person to join the Board.